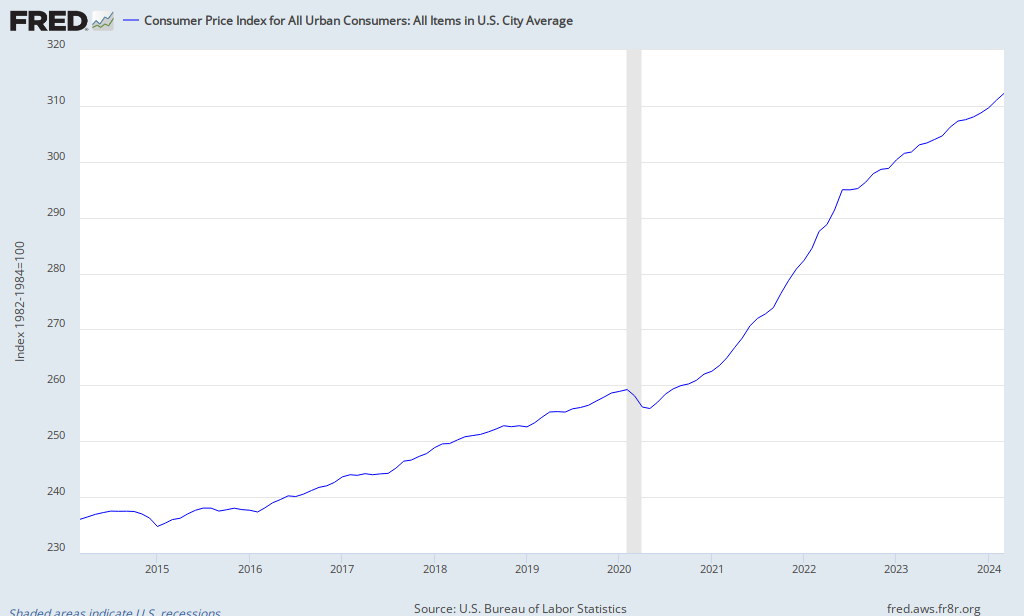

It's quite clear that headline CPI (meaning including food and energy prices) is still well below its longer term trend.

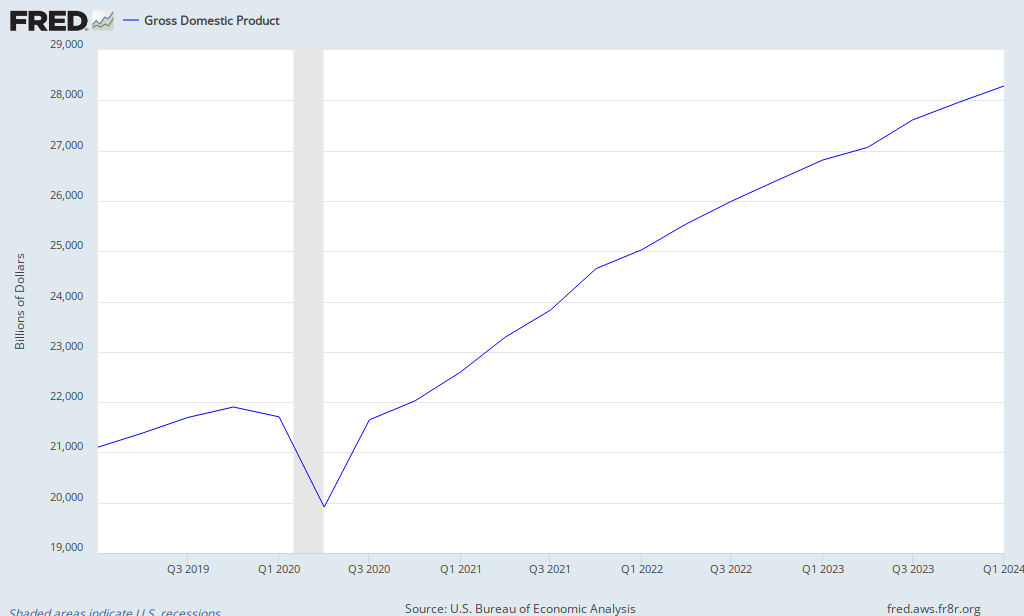

Another claim is that rising food and energy prices somehow more accurately reflect inflation than non-food and energy prices. This is another reason we should focus on NGDP and not CPI inflation. NGDP is clearly below trend, and is continuing to grow below its trend rate. Unless this changes, there either 1) no risk for inflation, or 2) nothing the Fed should do about it.

1) If this recent bump in inflation doesn't coincide with higher NGDP growth, not only shouldn't the Fed worry about it, they should try ease policy more. Any response to the recent "bout of inflation" will lead to more instability, not less. Unless we see higher NGDP growth, we can't see higher inflation unless the US undergone a real supply shock.

2) Now, if the US has undergone a supply shock and its productive capacity is greatly below 2008 levels, the Fed is damned either way. Either they can allow higher inflation (and keep NGDP growth at a similar rate), or they can keep inflation "in check" at ~2% (even though CPI is still well below trend!) and allow much higher unemployment (lower NGDP growth). Given the fact that unemployment is 8.8%, I think it's obvious that higher inflation would be preferable in this case. It would erode real wages and real debts could lower unemployment and reduce housing/financial problems.

The good news is that, at the moment, case #1 appears to be correct.

No comments:

Post a Comment