Firstly, let me justify the beginning and end dates for QE2.

I consider August 27, 2010 to be the effective beginning of QE2. On this day Bernanke delivered the

Jackson Hole speech in which he first hinted at another round of quantitative easing for the purpose of stimulating aggregate demand.

I consider April 27, 2011 to be the effective end of QE2 (although it would be more accurate to say "the end of any chance for additional easing of any kind unless things get much much worse"). The key quote by Bernanke was this :

“The trade-offs are getting — are getting less attractive at this point. Inflation has gotten higher. Inflation expectations are a bit higher. It’s not clear that we can get substantial improvements in payrolls without some additional inflation risk."

He hasn't given any indication he has changed his mind since, or that he plans to pursue any other form of easing.

Now that you know where I'm coming from, let's look at some asset prices!

No form of assets responded more clearly to the announcement and effective end of QE2 than equities did. Higher equity prices reflect better economic expectations and those expectations can become a self fulfilling prophecy through Tobin's q and wealth effects. Perhaps more importantly, higher stock prices also partially reflect a lower demand for dollars and that decreased demand immediately increases nominal spending. Also note the fall after QE2's "end".

Similarly, inflation expectations seem to have been strongly influenced by QE2's announcement. Again note the fall since QE2's end.

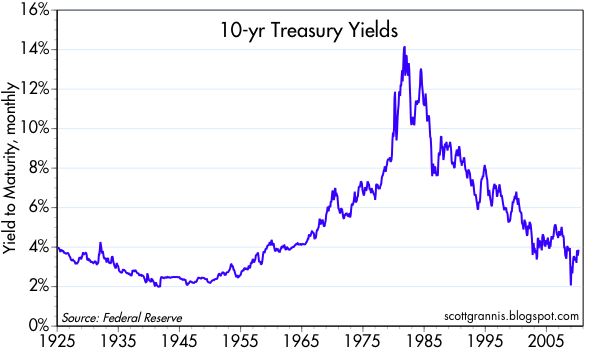

Treasury yields also noticeably rose in response to QE2. Many have pointed out that QE2 was supposed to reduce yields and have pointed to their rise as evidence against QE2's effectiveness (ignoring equity prices and inflation expectations), but higher yields were actually reflecting higher inflation real growth expectations. As Milton Friedman and Frederick Mishkin have pointed out, interest rates are NOT a reliable indicator of monetary policy and low interest rates can (and do) signal that money is tight. Higher interest rates

usually reflect a healthier economy when rates are this low. Unsurprisingly, the lower rates of the past month have been associated with worsening economic conditions.

Finally, the dollar has almost certainly fallen as a result to QE2. A falling dollar can be a bad sign if it is associated with high inflation (or supply side issues), but high inflation is still not a concern. In this case, a falling dollar helped increase net exports (by cheapening domestic goods) and as reflected less dollar hoarding (which is associated with lower V and more NGDP at any given supply of money). And once again, just as any prospects for additional easing ended the dollar began to rise.

Several excellent economists including

John Cochran and

James Hamilton have expressed doubts about the effectiveness of QE2. It's true that from a purely mechanical perspective, QE2 was likely irrelevant. So why the impact on markets?

The most likely explanation is that QE2 impacted medium term (2-10 years in the future) NGDP expectations. Anything the Fed can do to convince people that they will push for a higher NGDP in the future will improve expectations. Improved expectations have immediate effects on NGDP as they raise expected inflation/real growth and reduce the demand for dollars (thereby increasing V) today.

If this is the case, why does the Fed seem so uncomfortable with higher future NGDP? I think it's mostly a year over year % change issue versus a level targeting one. The Fed is worried that even temporarily higher rates of inflation and NGDP growth (to catch up to past trends) will be hard to push back down. That would be reasonable if expected inflation was above 3%, but at barely 2% these concerns are completely unjustified. The Fed is also likely concerned about bubbles, but with unemployment at 9% and a tremendous amount of slack in the economy, those concerns need much more justification and evidence backing them before they can be legitimately used to prevent easier policy.

(Half way through creating this post I saw that

Marcus Nunes beat me to it and posted something very similar. He makes somewhat different -- although equally valid -- points)

In the next few days I'll post something similar regarding the impact of QE2 on economic data.